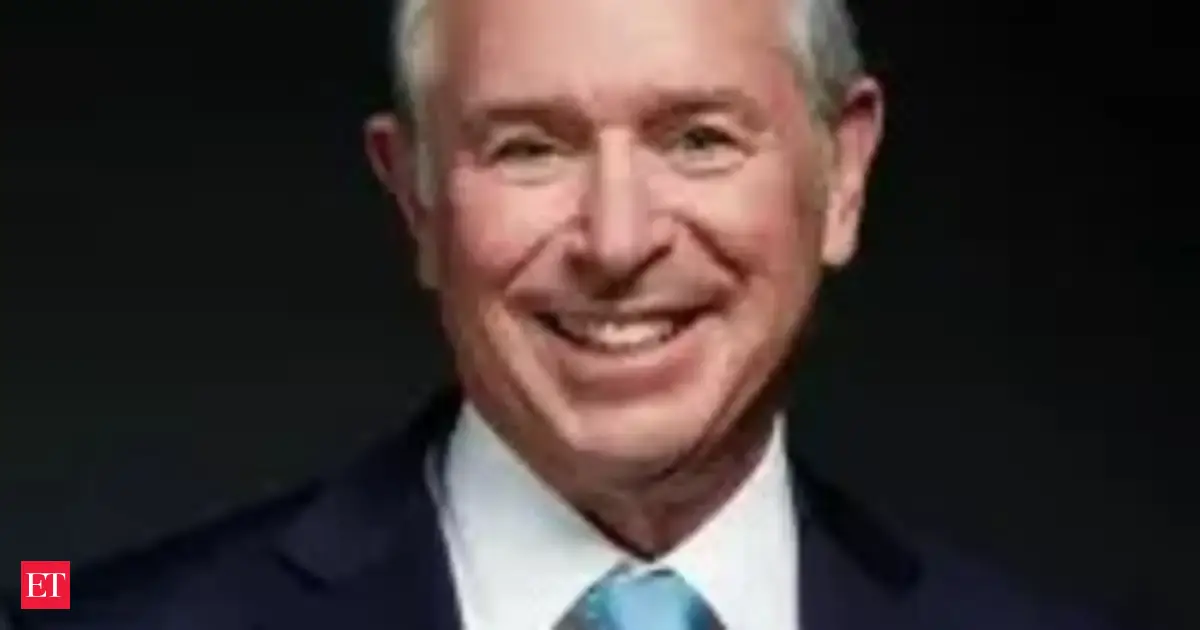

ET@Davos 2026: 'India has already arrived, no longer an emerging market,' says Blackstone CEO Schwarzman

Well, bless their hearts. It only took a global investment behemoth to officially declare what a billion people and their bustling economy have been screaming for years! The 'emerging market' label always felt a bit like calling a fully bloomed lotus an 'emerging bud.' While the validation from Blackstone CEO Stephen Schwarzman is certainly a powerful endorsement, one can't help but wonder if the actual 'emergence' of India happened long before the suit-and-tie brigade got around to updating their spreadsheets. Perhaps the real story here is less about India emerging, and more about global capital finally catching up to where the true action has been. It's high time the 'emerging' tag was retired; India isn't just at the table, it's setting it.

This seismic shift in perception, articulated by Stephen Schwarzman at ET@Davos 2026, isn't merely semantic; it's a strategic re-evaluation with significant implications for global capital flows. Blackstone, a long-time investor in the region, now views India as a fully-fledged economic powerhouse, no longer a market primarily defined by its growth *potential*, but by its consistent delivery. The firm explicitly cites India's colossal demographic dividend, robust governance, and a burgeoning consumer base as foundational strengths, solidifying its decision to expand investments across diverse sectors. This upgraded status signals an accelerated investment trajectory, from infrastructure to digital services, as Blackstone aims to deepen its already substantial footprint in a market it now considers mature, stable, and ripe for sustained, significant returns.